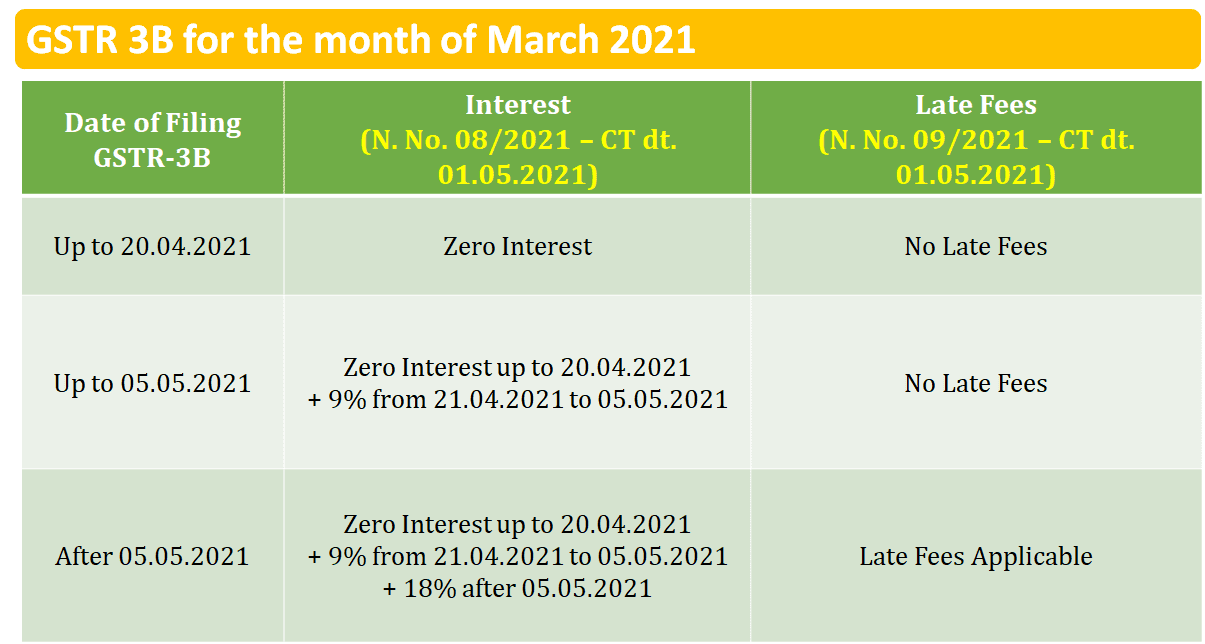

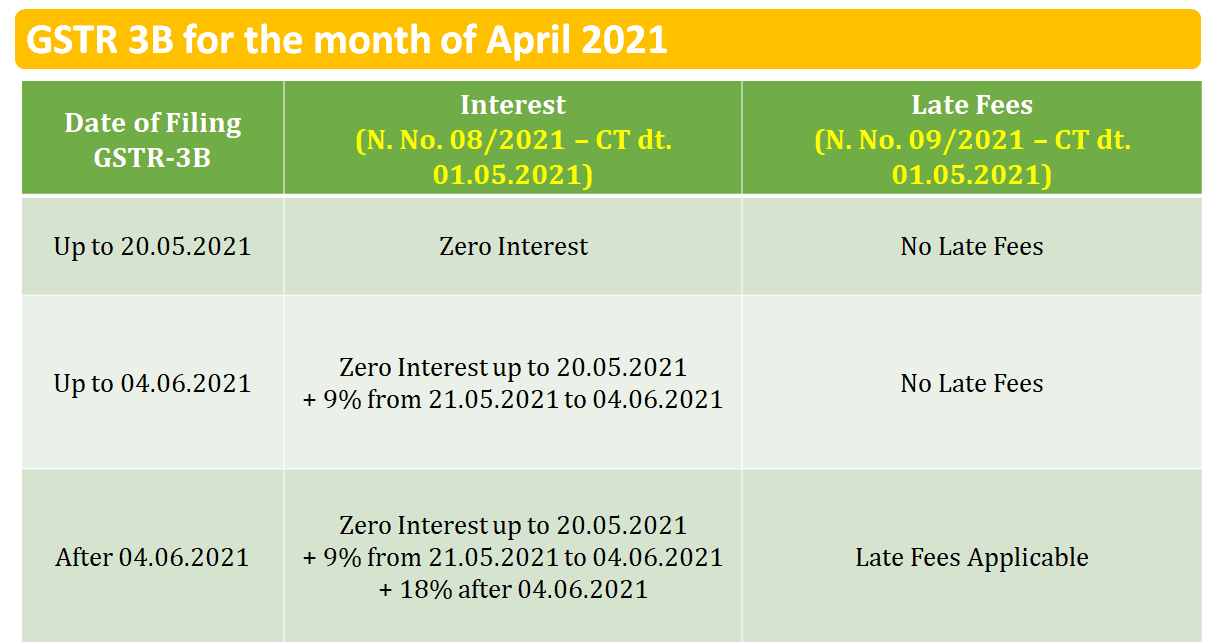

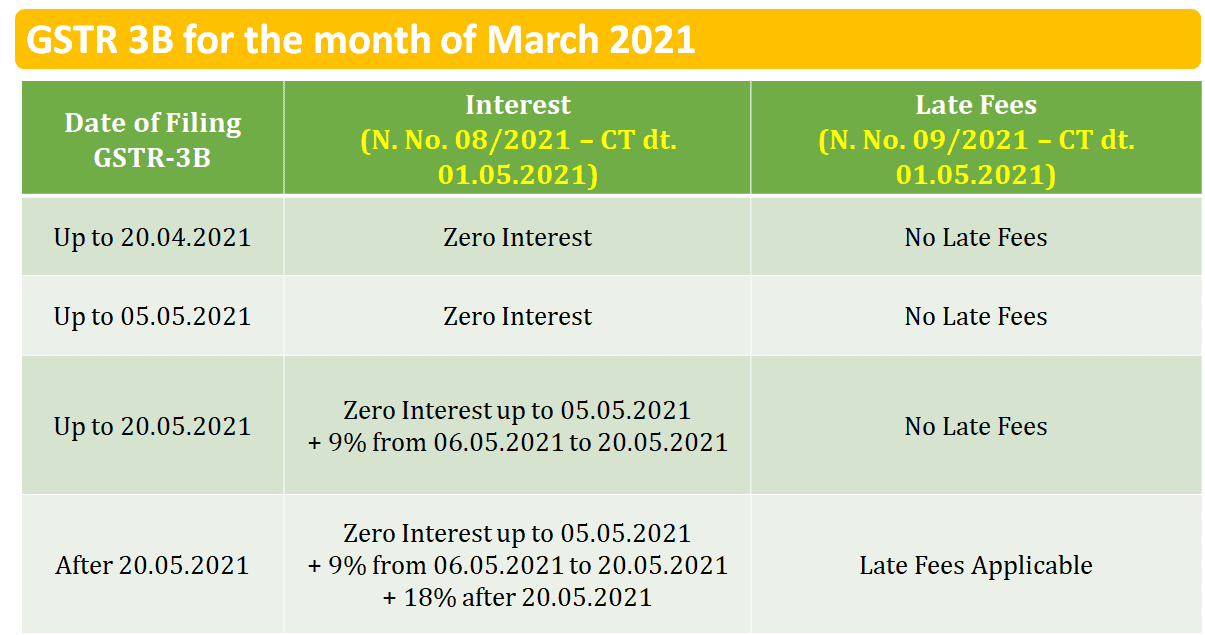

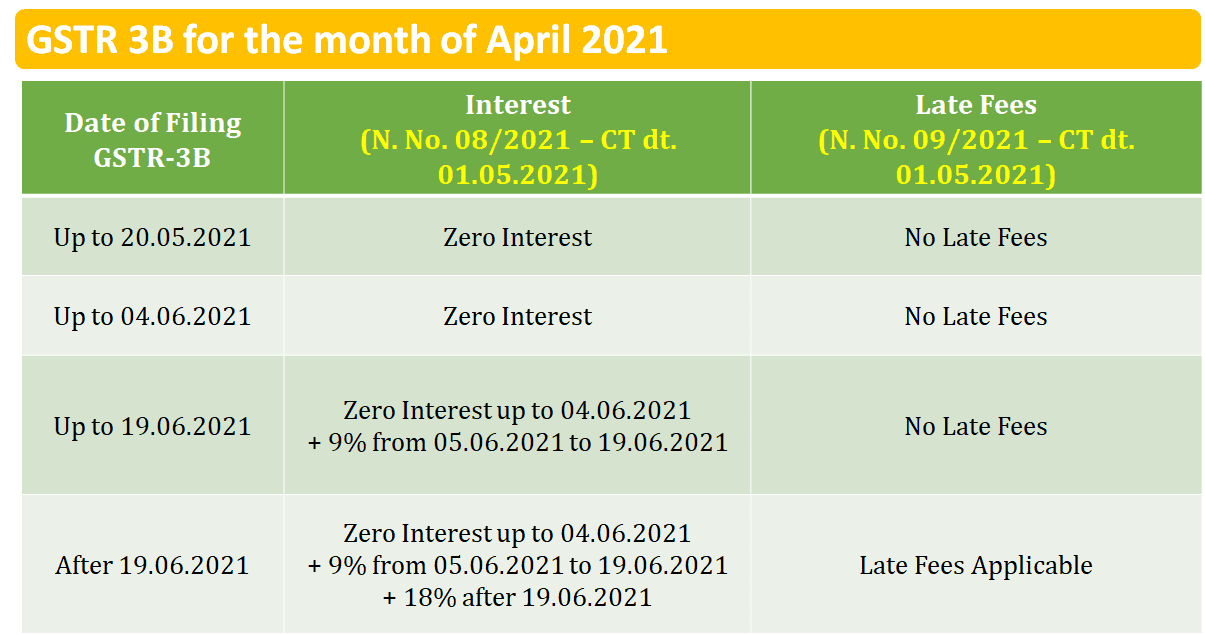

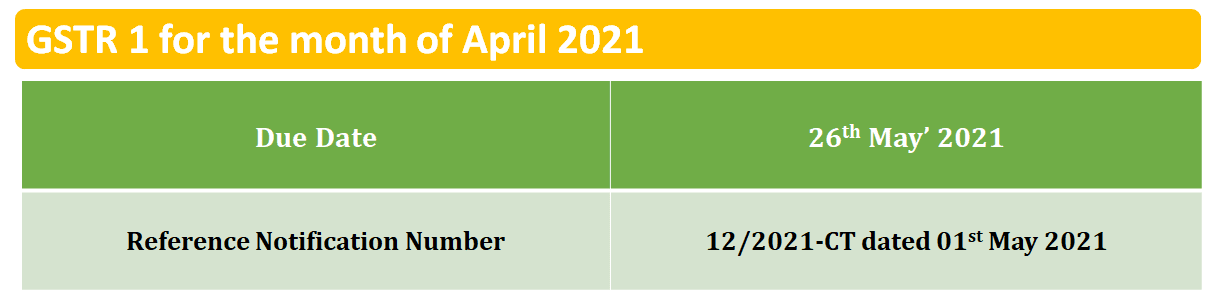

1. Taxpayers having turnover more than Rs.5 crores in preceding FY

2. Taxpayers having turnover up to Rs.5 crores in preceding FY-Monthly Filing of GSTR-3B and GSTR-1

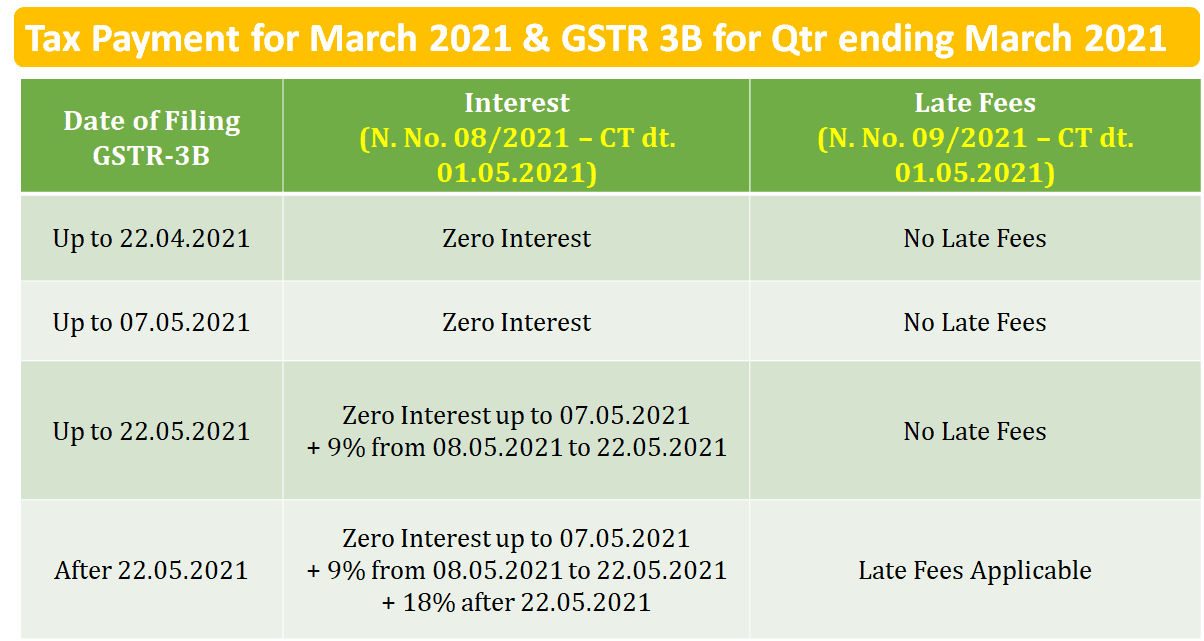

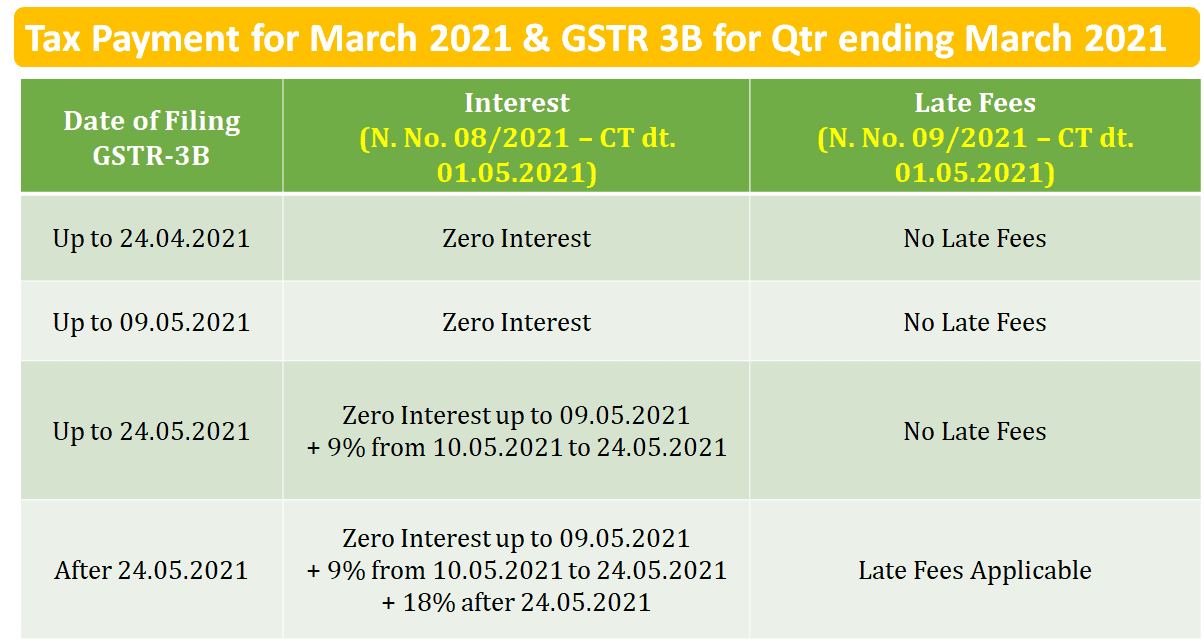

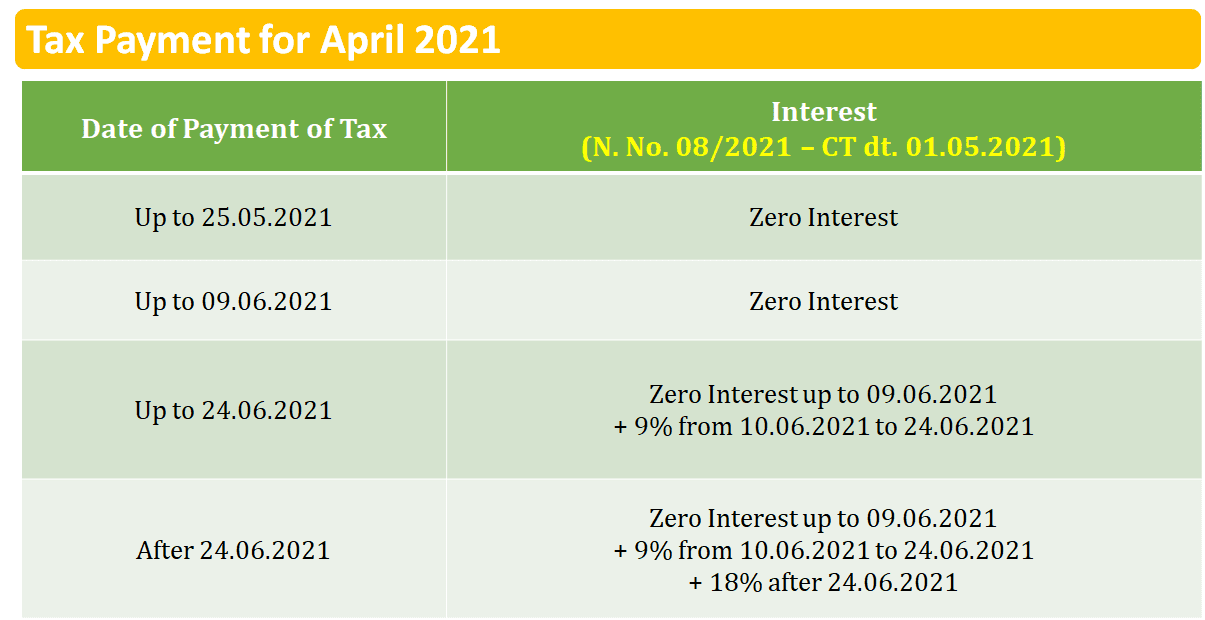

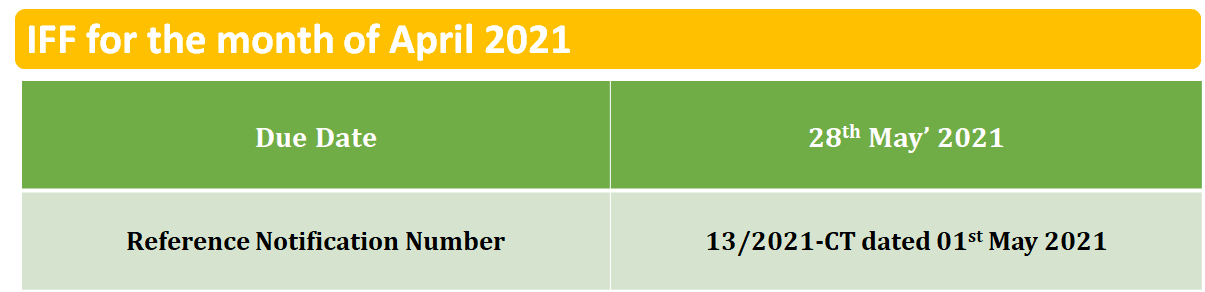

3. Taxpayers having turnover up to Rs.5 crores in preceding FY-Opted for QRMP Scheme

Note: Applicable for States having Principal Place of Business in Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep.

Note: Applicable for States having Principal Place of Business in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi.

Note: Applicable for States having Principal Place of Business in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi.

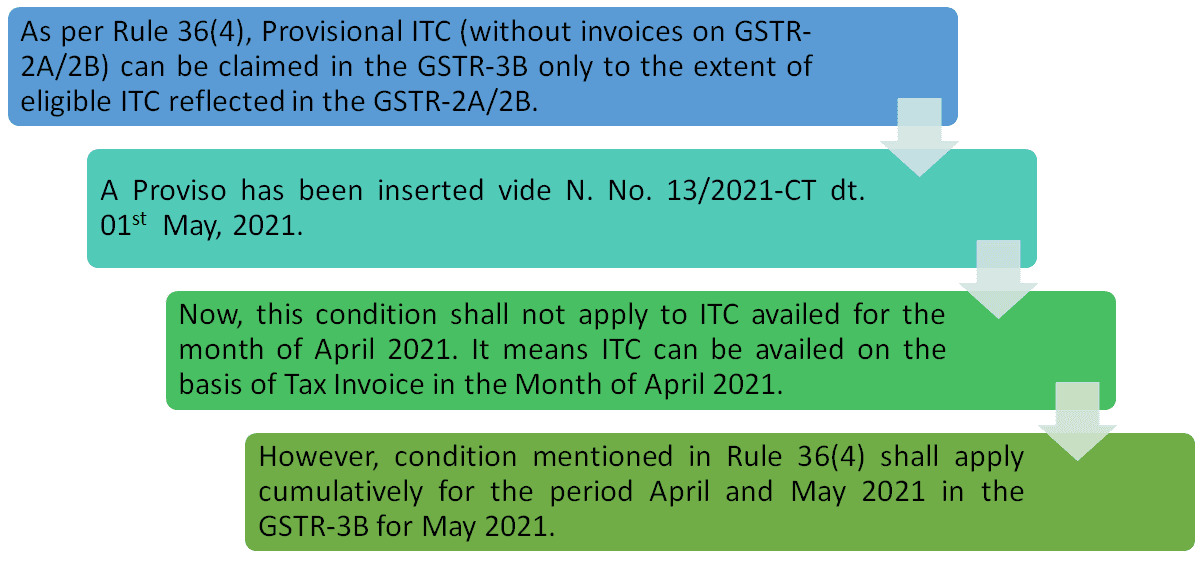

4. Amendment in Rule 36 (4)

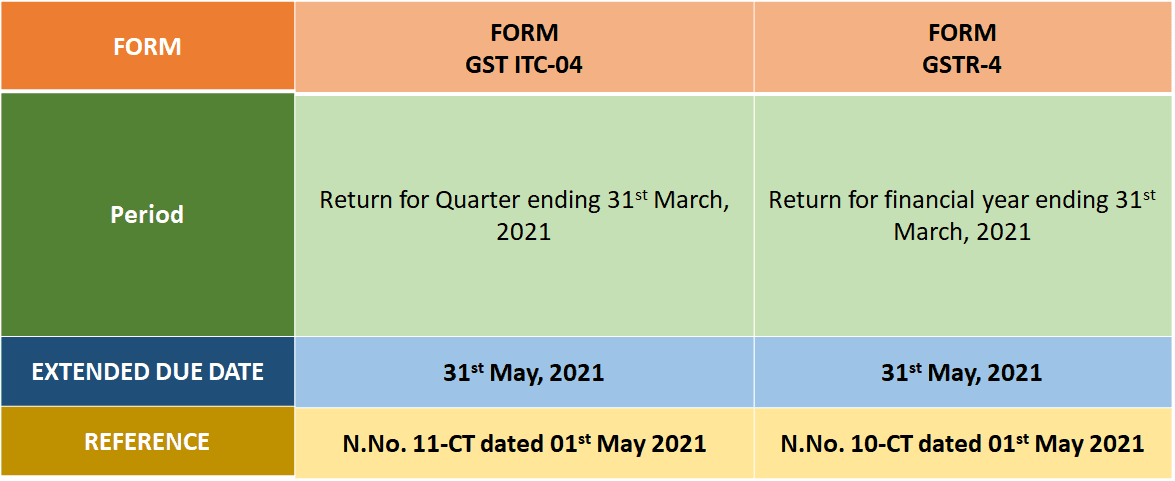

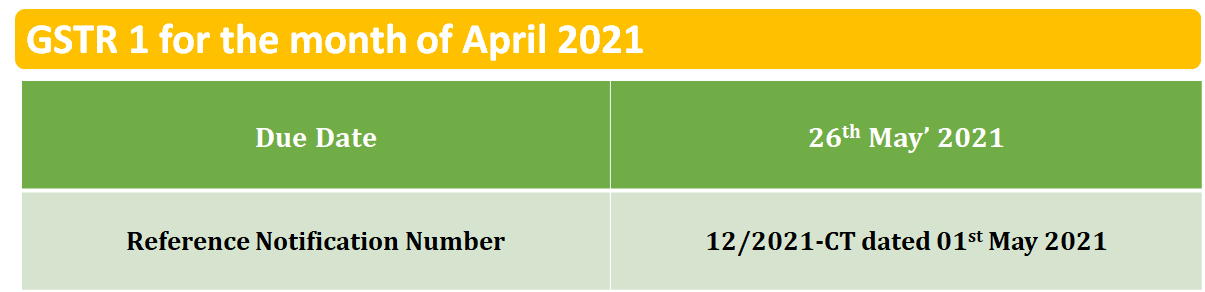

5. Extension of Other Due Dates