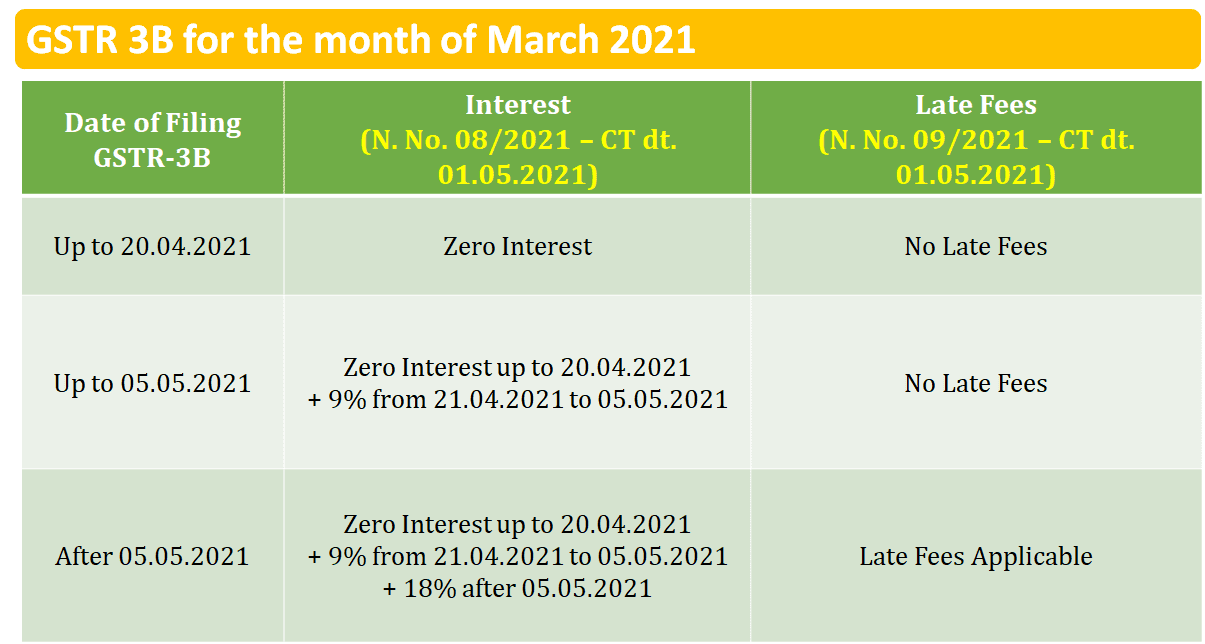

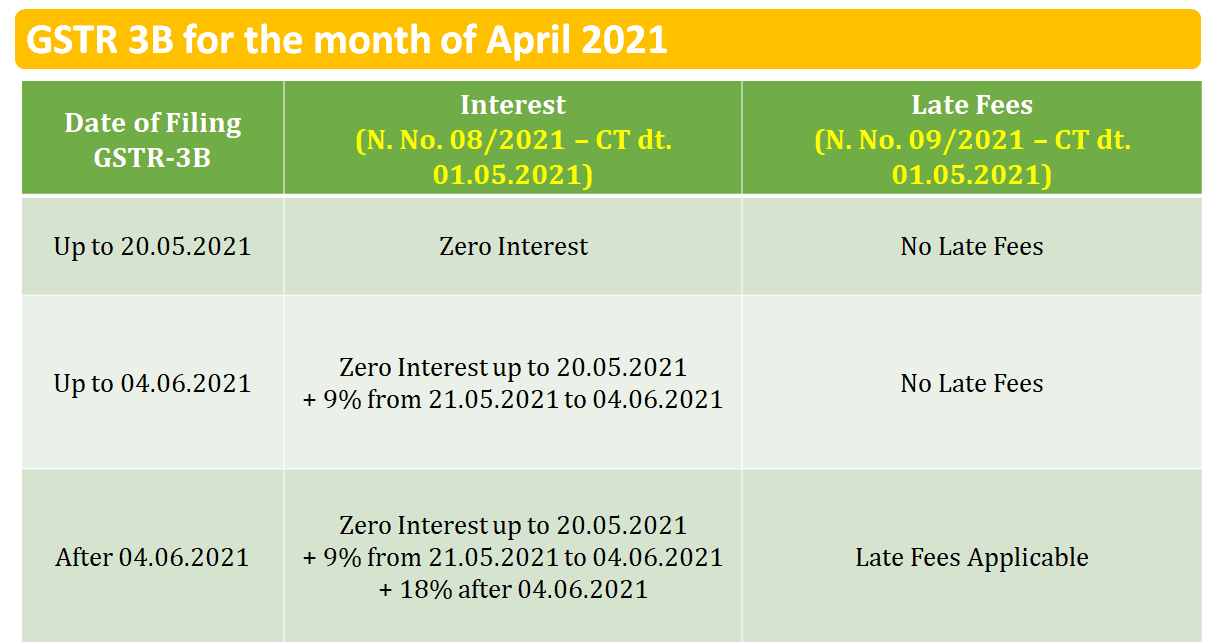

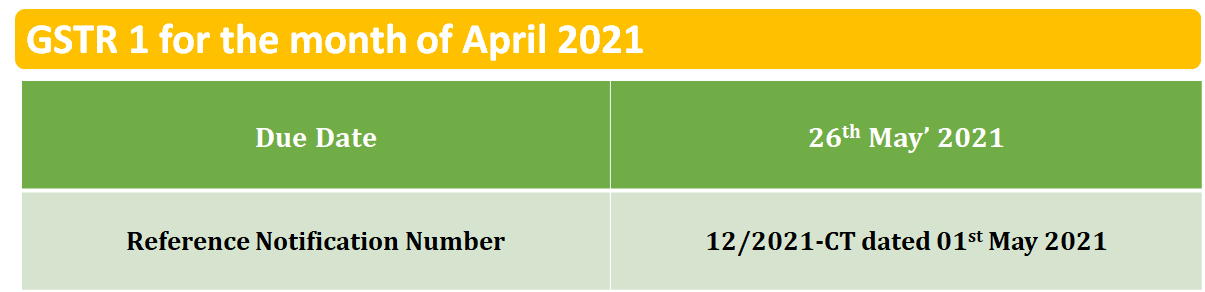

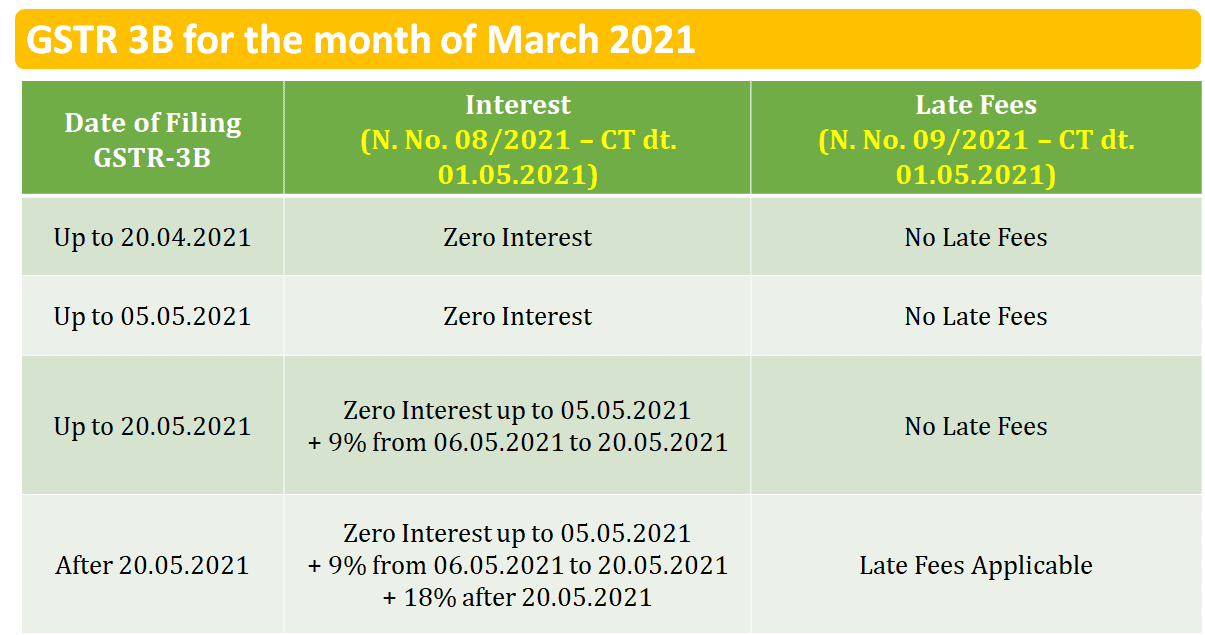

1. Taxpayers having turnover more than Rs.5 crores in preceding FY

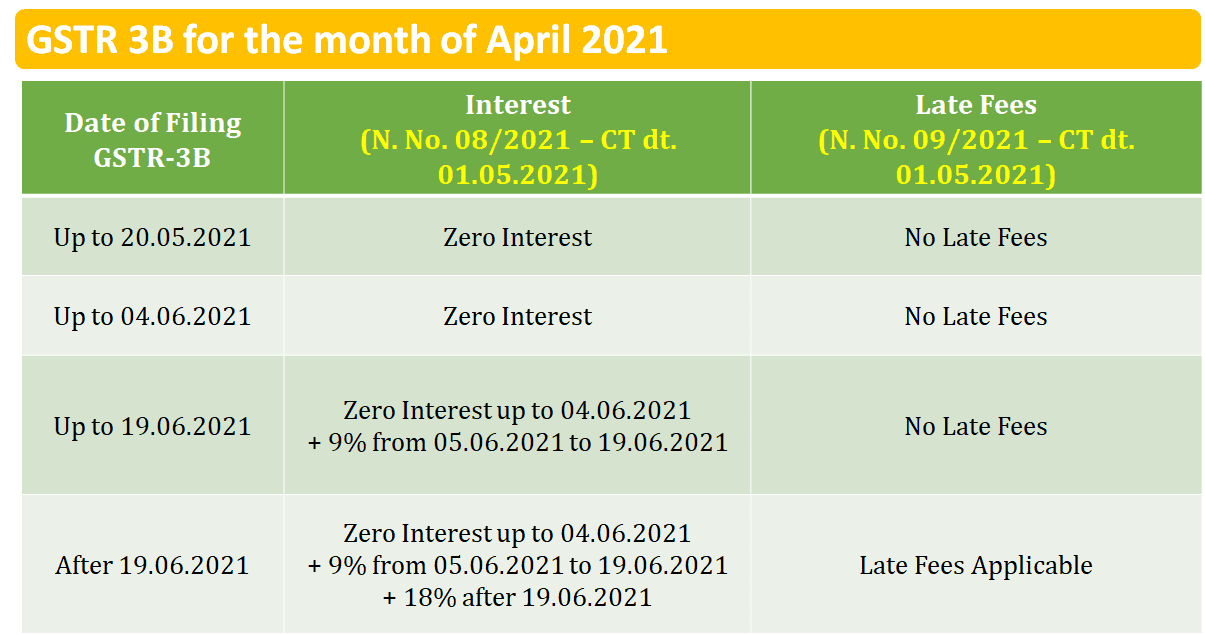

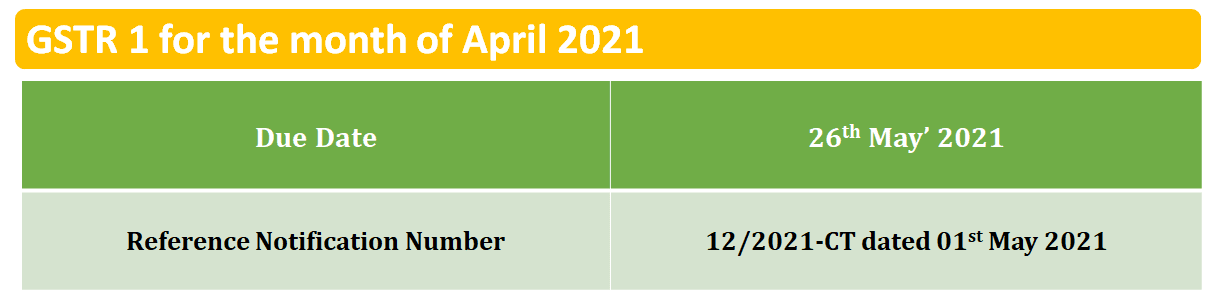

2. Taxpayers having turnover up to Rs.5 crores in preceding FY-Monthly Filing of GSTR-3B and GSTR-1

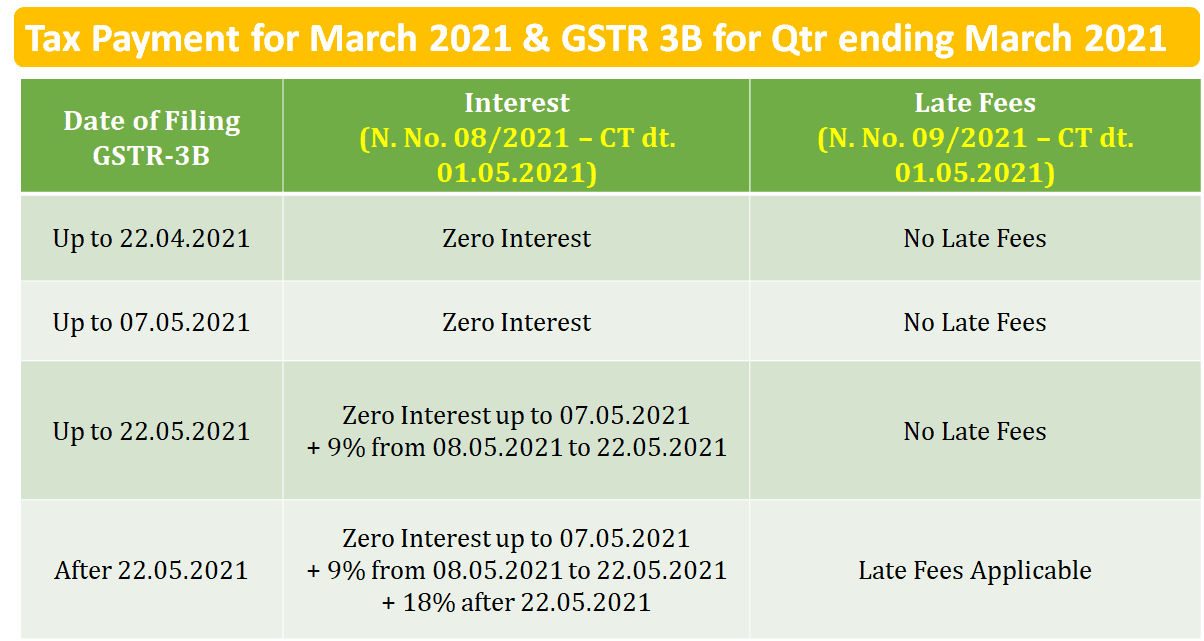

3. Taxpayers having turnover up to Rs.5 crores in preceding FY-Opted for QRMP Scheme

Note: Applicable for States having Princi...